2025年12月22日

早在两千多年前,《史记·李斯列传》与《史记·秦始皇本纪》就记载了“以吏为师”的典故,讲的是以政府工作人员为主体的政府工作,无论是社会道德,还是执行国家的法令,应做全社会的表率,其中最基本的,就是“无信不立”!按照现在的说法,政府要有公信力,尤其在处理老百姓的各种日常事务中,应确保民众对政府信赖利益的保障原则。

社会养老保险作为社会保障体系的核心组成部分,不仅关系到亿万民众的切身利益,更直接关联着政府在公众心中的信誉与权威。政府作为社会养老保险制度的设计者、推行者和最终责任承担者,其政策的连续性、执行的透明度以及承诺的兑现程度,都深刻影响着民众对制度的信任度,进而构成政府公信力的重要基石。

当政府能够通过完善的制度设计确保养老保险基金的稳健运行,通过公平的待遇调整机制保障参保人员的合理权益,通过畅通的信息渠道让公众清晰了解政策内容与资金流向时,民众便会对政府的治理能力和责任担当产生积极认知,这种认知转化为对政府的信任,促使社会形成可靠的预期和良好的秩序。反之,若养老保险政策朝令夕改、执行过程中官吏们凭借“根据相关政策”的一句笼统托词,可以言而无信、约而不守,或基金管理存在漏洞导致支付能力受质疑,公众对政府的信任便会受到冲击,引发对公共政策的普遍疑虑,小到民众的生活,大到社会的稳定与发展就失去指望,所谓的礼崩乐坏、法制颓废和无可救药了,往往从此得以萌生与蔓延。

因此,社会养老保险制度的有效运行与政府公信力的建设之间存在着密不可分的正向互动关系,前者的完善是后者提升的重要途径,而后者的坚实则为前者的可持续发展提供了根本保障。本文作者陈树庆,就自己在办理社会养老保险时所遭遇的情况进行维权,不妨就政府公信力这个问题,首先撕开一层面纱:

《政府信息公开申请书》

杭州市拱墅区人力资源和社会保障局:

申请人陈树庆,男,浙江省杭州市人,现住杭州市拱墅区大关苑东五苑6幢5单元202室,身份证号330106196509260073,联系电话15958160478。

至2025年12月17日,申请人陈树庆已达法定退休年龄60周岁+3个月,实际已缴社会保险统筹24年4个月,超过了15年的最低缴费年限。2025年12月17日上午9时许,申请人到贵局(拱墅区人社局)设在拱墅区政务服务中心的办公场所办理退休手续,办事人员以陈树庆曾经因遭2007年“煽动颠覆国家政权罪”判刑4年和2016年“颠覆国家政权罪”判刑10年6个月为由,社保缴费年限扣除两项刑期累加,剩余缴费年限只有九年多,不足最低缴费年限15年的规定,拒不办理申请人的退休资格,只是一味要求申请人对服刑期间已交的社会保险先行退费。

由此,申请人产生两项疑惑并提出相应的两项政府信息公开事项:

一、20多年来,申请人、申请人家属、申请人工作或社保挂靠的单位替申请人缴纳社会保险,从未遇到服刑期间不能缴费的明确告知,甚至2025年3月10日申请人最后一次刑满释放后,到贵局设在拱墅区香积寺东路58号的政务服务中心几次补缴中间断交的最近几年(这其中就包括部分刑期内的期间)社保费用也都顺利完成。贵局在收取保险缴费的时候好好的,现在要贵局履行保险责任的时候,突然变卦,以所谓“相关政策”为托词,拒不履行贵局应负的社会保险责任,让申请人对政府信赖利益的保护原则顿生疑惑。为此,申请人提出的第一项要求政府信息公开事项是:服刑期间已经缴纳社保的期限无效并退回缴费的具体法律(包括政策)依据,包括法律(政策)的具体名称,第几条第几款。当然,答复函中对这些法律(政策)的内容予以清晰载明,则更好。

二、贵局在政务服务中心的工作人员让申请人先退费,口头答应退费后才能续办申请人退休资格和待遇的其他审定工作,申请人认为,退完刑期内的已缴费社保费用,剩余期限已远远不足办理退休的最低缴费年限15年的规定,届时申请人不仅现在办不了退休,连接下来的现实经济负担和最终养老社会保险结果也是无从确信和依托。为此,申请人提出的第二项要求政府信息公开事项是:1、具体退费流程,根据缴费人不同而确定的不同缴费时段,各时段具体退费数额(或退费内容与计算标准);2、退费完毕后的详细善后流程与结果预判,同时注明所依据的法律(政策)的条款及内容则更好。

本《政府信息公开申请书》恳请贵局以书面的形式具体明确答复,请求不要再派员含糊其辞的“根据相关政策”及可以不认账、不负责任的任何口头“咨询”或“建议”。

申请人:陈树庆

申请日期: 2025年12月 21 日

附件1:申请人陈树庆身份证复印件(包含正反两面)

2:拱墅区政府信息公开申请表

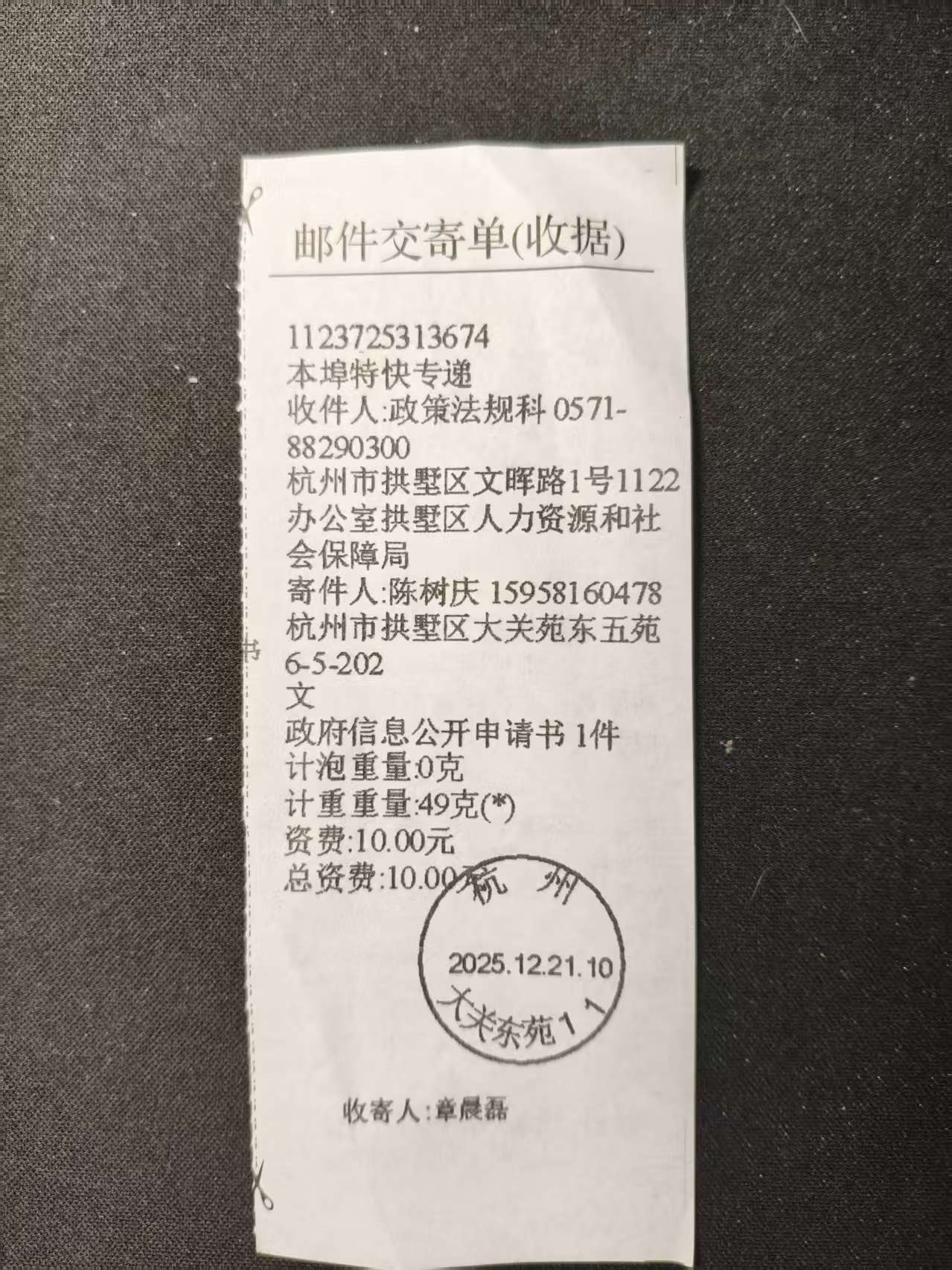

注:本《政府信息公开申请书》已于2025年12月21日寄发拱墅区人力资源和社会保障局。

Chen Shuqing: Social Pension Insurance and Government Credibility

22 December 2025

As early as more than two thousand years ago, the Records of the Grand Historian (Shiji), in the “Biography of Li Si” and “Annals of the First Emperor of Qin”, recorded the saying “taking officials as teachers” (yi li wei shi). It described how government work, carried out mainly by state officials, should serve as an example to the whole of society, whether in terms of social morality or in the enforcement of state laws. The most basic requirement is that “without trust, nothing stands”. In today’s terms, the government must possess public credibility, especially when handling the various everyday affairs of ordinary people, and must uphold the principle of protecting the legitimate expectations of citizens who place their trust in it.

As a core component of the social security system, social pension insurance not only concerns the vital interests of hundreds of millions of citizens, but also directly relates to the government’s credibility and authority in the eyes of the public. As the designer, implementer and ultimately responsible body for the social pension insurance system, the continuity of government policy, the transparency of its implementation, and the extent to which its promises are honoured all profoundly affect the level of public trust in the system, and thus form an important foundation of governmental credibility.

When the government is able, through sound institutional design, to ensure the steady operation of pension insurance funds, to protect the reasonable rights and interests of contributors through fair mechanisms for adjusting benefits, and to make full use of clear information channels so that the public can understand policy details and the flow of funds, citizens will develop a positive view of the government’s capacity to govern and its sense of responsibility. This perception is transformed into trust in the government, helping society to form stable expectations and a healthy order. Conversely, if pension insurance policies change at the drop of a hat; if, in the course of implementation, officials can go back on their word and fail to honour agreements, brushing things aside with the vague phrase “in accordance with relevant policies”; or if there are loopholes in the management of the fund which cast doubt on its ability to meet its obligations, then public trust in the government will inevitably be shaken. This will trigger widespread doubts about public policy, and the consequences will range from undermining people’s daily lives to undermining social stability and development as a whole. A breakdown in social norms, the decline of the rule of law and a sense that matters are beyond remedy often begin and spread in just such a fashion.

Therefore, there is a closely interlinked, positive interaction between the effective operation of the social pension insurance system and the building of governmental credibility. The improvement of the former is an important way to enhance the latter, while the solidity of the latter provides the fundamental guarantee for the sustainable development of the former.

In this article, the author, Chen Shuqing, describes how he defended his rights in the face of the situation he encountered while handling his social pension insurance, and in doing so lifts, to begin with, one corner of the veil over the question of government credibility:

Application for the Disclosure of Government Information

To: Gongshu District Human Resources and Social Security Bureau, Hangzhou

Applicant: Chen Shuqing, male, resident of Hangzhou, Zhejiang Province.

Current address: Room 202, Unit 5, Building 6, Daguan Garden East Fifth Court, Gongshu District, Hangzhou.

ID number: 330106196509260073

Contact telephone: 15958160478.

As of 17 December 2025, the applicant, Chen Shuqing, has reached the statutory retirement age of 60 years plus 3 months, and has actually paid into the pooled social insurance fund for 24 years and 4 months, exceeding the minimum contribution period of 15 years. At around 9 a.m. on 17 December 2025, the applicant went to your Bureau’s office (Gongshu District Human Resources and Social Security Bureau) located in the Gongshu District Government Service Centre to complete retirement procedures. The staff member, however, on the grounds that the applicant had once been sentenced to four years’ imprisonment in 2007 for “inciting subversion of state power” and to ten years and six months’ imprisonment in 2016 for “subversion of state power”, deducted from his contribution years the total length of those two prison terms. As a result, the remaining contribution years were calculated as only a little over nine years, falling short of the minimum required 15 years of contributions, and the staff member refused to process the applicant’s retirement eligibility. The applicant was repeatedly told that he must first apply for a refund of the social insurance contributions paid during his periods of imprisonment.

This has given rise to two areas of doubt on the part of the applicant, leading to two corresponding requests for the disclosure of government information, as set out below:

I. Over more than twenty years, the applicant, the applicant’s family members, and the work units or entities with which his social insurance was registered have paid social insurance contributions on his behalf. At no point was there any clear notification that contributions could not be made during periods of imprisonment. Even after the applicant’s most recent release on 10 March 2025, when he went several times to your Bureau’s office at No. 58 Xiangjisi East Road, Gongshu District Government Service Centre, to make back payments for the recent years in which contributions had been interrupted (including certain periods falling within his prison terms), all such payments were completed without hindrance. Your Bureau had no issue collecting these insurance contributions at the time; yet now, when your Bureau is called upon to fulfil its insurance obligations, it suddenly changes its position, using “relevant policies” as a pretext to refuse to honour its social insurance responsibilities towards the applicant. This causes the applicant to harbour serious doubts as to whether the government is upholding the principle of protecting the legitimate expectations of citizens who place their trust in it.

Accordingly, the first matter on which the applicant requests disclosure of government information is as follows:

the specific legal (including policy) basis for invalidating and refunding social insurance contributions already paid during periods of imprisonment, including the exact names of the relevant laws (or policies), and the relevant articles and clauses. Of course, it would be even better if the reply letter could set out the content of these laws (or policies) clearly and in full.

II. The staff of your Bureau at the Government Service Centre asked the applicant to apply for a refund first, verbally promising that only after the refund had been processed could they continue examining the applicant’s retirement eligibility and benefits. The applicant considers that, once the social insurance contributions paid during his prison terms have been refunded, the remaining contribution years will be far short of the minimum required 15 years, meaning that not only will he be unable to retire now, but he will have no way of being certain or having any guarantee regarding his future financial burden and the eventual outcome of his pension insurance.

Accordingly, the second matter on which the applicant requests disclosure of government information is as follows:

- The specific refund procedures, including the different contribution periods determined by the differing identities of the payers, and the exact refund amounts for each contribution period (or the content of refunds and the calculation criteria);

- The detailed follow-up procedures and projected outcomes after the completion of the refund process. It would again be preferable if the relevant articles and content of the laws (or policies) on which these are based could be clearly indicated.

Through this Application for the Disclosure of Government Information, the applicant earnestly requests your Bureau to provide a specific and clear written reply, and asks that you no longer send staff to give vague responses such as “in accordance with relevant policies”, nor offer any oral “consultations” or “suggestions” from which you may later refuse to accept responsibility or deny what has been said.

Applicant: Chen Shuqing

Date of application: 21 December 2025

Attachments:

- Photocopy of applicant Chen Shuqing’s ID card (both front and back)

- Gongshu District Government Information Disclosure Application Form

Note: This Application for the Disclosure of Government Information was sent to the Gongshu District Human Resources and Social Security Bureau on 21 December 2025.